Why Is Blockchain So Innovative Yet Stuck in the '90s?

The Paradox of Decentralization: Why Complexity Is Holding Blockchain Back

At the coworking space where I often work, I frequently get asked, “What do you do for a living?”

When I reply that our company operates in the blockchain industry, the response is almost always the same:

"Oh! That sounds complicated! I don’t understand any of that", I’ve been hearing this for years, and I’ve come to realize that our industry is, indeed, far too complex.

It’s hard to learn, difficult to use, and even harder to explain.

To be fair, our industry has made significant strides toward mass adoption in recent years.

Many improvements have focused on accessibility, but the reality is that much of the technology remains confusing and intimidating for newcomers.

This is why so much effort is now dedicated to enhancing user experience and making blockchain easier to navigate for everyone.

Here are some of the key advancements in this direction:

Account Abstraction: Simplifying User Experience

One of the most promising advancements is Account Abstraction (AA), a concept introduced by Vitalik Buterin nearly nine years ago. This technology enables account management on blockchains like Ethereum, eliminating some of the most intimidating barriers to entry.

Traditionally, users must handle private keys and gas fees. Two elements that can be overwhelming for non-experts. However, with the introduction of the ERC-4337 standard, new mechanisms have been implemented to simplify these processes.

For example, the rise of Smart Accounts, enabled by Account Abstraction, allows for easier private key management. Smartphones can even act as hardware wallets, making it possible to recover accounts without manually storing complex seed phrases.

Liquidity Aggregation: Fewer Trades, More Efficiency

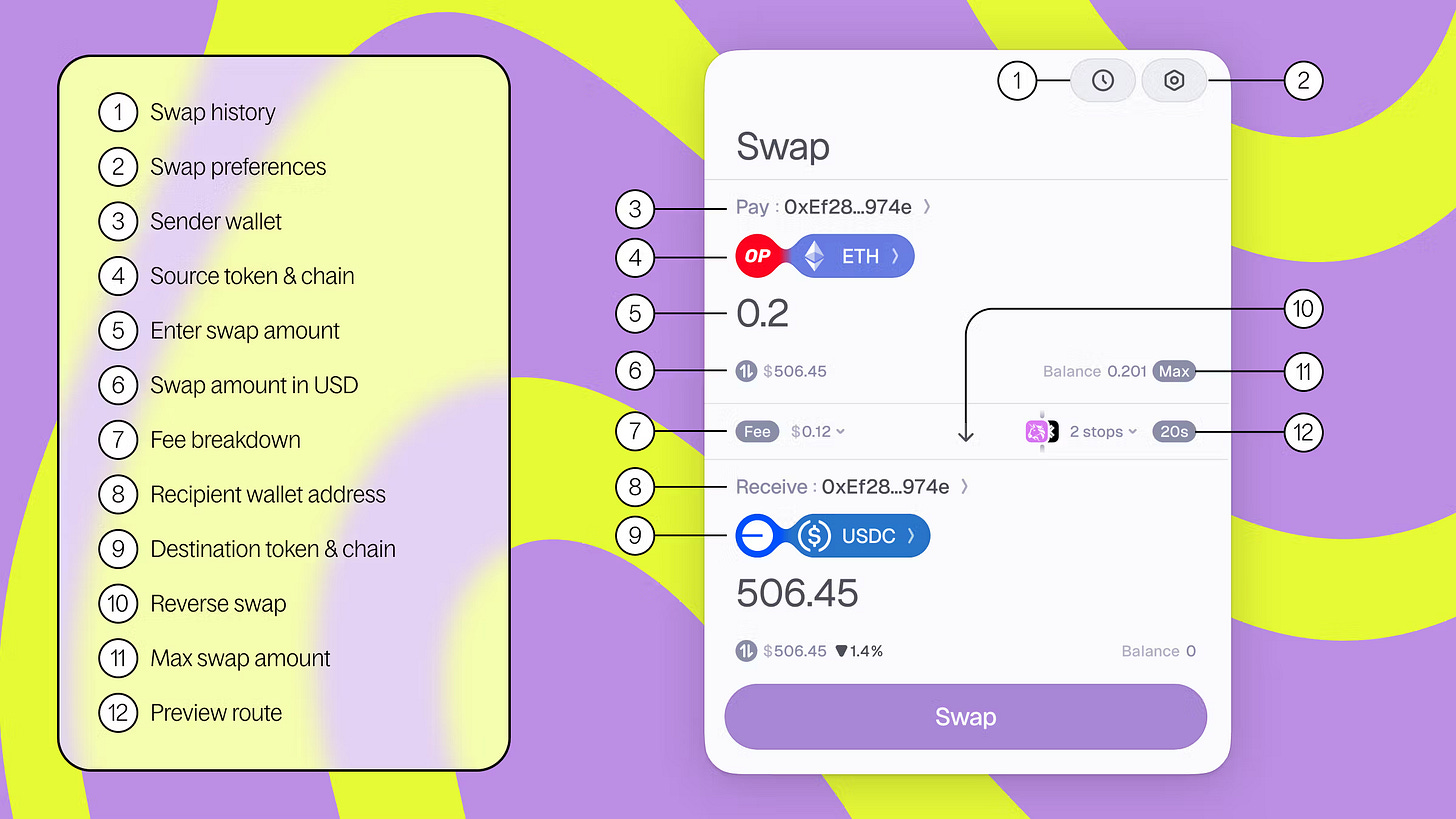

Another huge pain point in crypto is the need for cross-chain swaps to access different trading and yield farming opportunities.

Today, protocols like Squid Router and LI.FI are revolutionizing this process by allowing users to move funds across multiple blockchains with a single click, eliminating the need for multiple bridges and decentralized exchanges (DEXs).

These liquidity aggregators consolidate assets from various chains, reducing friction and significantly improving the user experience.

Improved UX in Wallets and dApps

Improved UX in Wallets and Decentralized applications (dApps) are also evolving to be more intuitive. Solutions like Rainbow, Argent, and MetaMask Snaps integrate features that simplify interactions, such as direct DeFi connections and in-app notifications.

At the same time, dApps are evolving to feel more like traditional Web2 applications, making them more accessible to new users.

Automation and AI: The Next Step

Artificial intelligence (AI) is another game-changer for blockchain usability. AI-powered tools, such as Eliza, provide chatbot assistants that help users navigate blockchain interactions more smoothly.

From automated trading bots to virtual assistants that guide users through transactions, AI is becoming an essential tool for simplifying blockchain interactions and enhancing security.

However, despite all these improvements, managing wallets and using DeFi in 2025 is still too complex for the average person.

The barriers, private key management, fragmented liquidity across multiple blockchains, and unintuitive DeFi interfaces continue to obstruct mainstream adoption.

The Paradox of Decentralization

This leads to an ironic paradox: crypto has always championed decentralization and financial freedom, yet its complexity is pushing the industry toward increasing centralization.

In practice, blockchain’s complexity means that only a small group of highly skilled users can fully benefit from it.

Meanwhile, large institutional investors and early adopters consolidate power, taking advantage of opportunities that remain out of reach for the average user.

The numbers speak for themselves: despite years of innovation, mass adoption is still limited.

And that should be a wake-up call for the industry.

How often do we hear the phrase "Don’t trust, verify"? Yes, even in traditional finance, you need to research the companies you invest in. But in crypto, users are also expected to verify the very infrastructure they operate on.

The reality is that the world is not made up solely of computer scientists or engineers. Most people don’t know how to read code, and expecting them to do so is overwhelming.

If we force users to study the code just to feel safe using an application, we are setting them up for failure and that should be seen as a major shortcoming of our industry.

And even with a deep understanding of the code, there’s always the risk of encountering a bug or worse, falling victim to an exploit by a hacker.

Just look at what happened a few days ago with the biggest hack in our industry’s history, which involved Bybit.

Learning from the Past

Our industry tends to distance itself from traditional centralized systems, but that doesn’t mean we should ignore past lessons.

Think about how the internet has evolved. There was a time when accessing a website meant manually typing an IP address, or when users had to enter their ISP login credentials just to get online. Shoutout to everyone who remembers setting specific DNS, like 192.168.1.1, just to play video games online!

Now, we simply type a domain name, and our devices connect to the internet automatically— no technical knowledge required.

Yet, in crypto, users are expected to copy and paste a long alphanumeric public key just to make a transaction, while constantly fearing that a single typo could result in losing their funds forever.

We also force them to use browser extensions to manage their assets and let’s be honest, if you asked the average person what a browser extension is, most wouldn’t have a clue.

And then there’s the seed phrase users must store it securely, knowing that if they lose it, their assets are gone forever.

How can we expect mass adoption when our industry still operates with a 1990s-level user experience?

This is why centralized exchanges (Binance, Coinbase, Kraken) have made huge improvements in usability, allowing them to dominate the industry today.

While they can be seen as centralized entities with a different mission than the fundamental vision of our industry, they serve as an entry point for newcomers, helping them get started with the tools that the crypto ecosystem offers.

For someone unfamiliar with the space, setting up a non-custodial wallet can be quite challenging, whereas opening an account on a CEX is much more intuitive and accessible. This accessibility makes centralized exchanges the preferred starting point for most users.

Meanwhile, DeFi is still lagging behind, struggling to offer a truly seamless user experience. Most DeFi projects still prioritize technical complexity over usability, making them inaccessible to a wider audience.

A Shift in Mindset

If we truly want blockchain technology to reach the masses, we need to overcome ideological barriers and embrace solutions that genuinely simplify the user experience.

There are promising innovations. Account Abstraction, liquidity aggregation, improved wallets, but many of these still feel like patches rather than core improvements.

When building non-crypto applications, developers often ask: "Can my grandmother use this product?"

But in crypto, we rarely ask that question. Instead, we celebrate complexity, assuming that if something is difficult to use, it must be "innovative" or "to the moon."

This mindset needs to change.

Decentralization only succeeds with mass adoption, not by remaining exclusive to a niche of experts.

Instead of treating technological barriers as an inevitable challenge, we should see them as failures to overcome.

The Road Ahead

It’s time for the industry to prioritize usability, accessibility, and simplicity-not as afterthoughts, but as fundamental pillars of development.

Blockchain applications must be built with user experience at their core, rather than treating ease of use as a secondary concern.

Only by embedding simplicity from the ground up can we hope to reach a broader audience and drive real adoption.

Additionally, a liquidity aggregation protocol that fully integrates multiple CEXs into a single environment could be the breakthrough this industry needs. Despite significant efforts, users still often have to navigate multiple protocols just to transfer an asset from one ecosystem to another.

In this regard, Polaris has been announced, an idea born from Osmosis CEO Sunny Aggarwal. According to the team, the platform will enable users to trade tokens across multiple blockchains through a single interface, eliminating the need for multiple wallets, bridges, and gas tokens. While still in development, this project holds great potential for dramatically improving user experience, demonstrating that even decentralize exchanges are moving in this direction.

However, improving usability alone is not enough. Education and open dialogue are just as crucial. Instead of isolating ourselves from traditional institutions, we should foster collaboration with regulatory bodies. Demystifying blockchain, and working toward a regulatory framework that supports innovation

Crypto or blockchain in general, shouldn’t be viewed as a lawless space or a tool for illicit activity, but as the next evolution of financial systems, one that provides people with greater financial autonomy.

To achieve this, we must, pardon the obvious metaphor, but I can’t think of a more fitting phrase-build bridges, not walls.

The more we cooperate and integrate, the closer we get to realizing the true vision of blockchain: an open, democratic, and accessible financial system for all.