The Media’s Crypto Dilemma: Changing the Narrative

The Media’s Portrayal of Cryptocurrencies: A Persistent Stereotype

Have you ever noticed a recurring theme when you turn on your television, browse Netflix, or watch a blockbuster movie? In the past few years, cryptocurrencies have frequently been depicted as tools for hackers, drug traffickers, or tax evaders, a portrayal that reduces a complex financial innovation to mere criminal activity.

Consider, for example, the TV series Black Mirror, which aired an episode in 2023 framing cryptocurrencies in a dystopian and dangerous light. In Euphoria, drug dealers insist on crypto payments. Meanwhile, the recent series Zero Day features a criminal organization using a Bitcoin mining farm as a front for illicit activities.

These portrayals are far from isolated incidents. They reflect a broader trend in mainstream media, which tends to highlight the darker side of the crypto industry while largely ignoring its potential benefits.

The Impact of Media on Public Perception

Why does the portrayal matter? Media plays a crucial role in shaping public opinion and influencing how people perceive new technologies. When TV series and movies repeatedly reinforce the idea that cryptocurrencies are primarily associated with illicit transactions, the general public internalizes this as reality.

This isn’t just speculation. A recent study by the Pew Research Center found that 70% of Americans associate cryptocurrencies with illegal activities. This perception is heavily influenced by mainstream news outlets like CNN and Fox News, which often focus on the risks and controversies surrounding crypto.

On the other hand, specialized platforms like CoinDesk and Decrypt focus on blockchain innovation and financial inclusion, creating a divide between those who see crypto as a threat and those who view it as a technological breakthrough.

However, perception is not static, it evolves over time. If major financial institutions and government treasuries begin treating Bitcoin and other cryptocurrencies as legitimate assets, the narrative around crypto could begin to shift. Instead of being seen as a tool for crime, crypto might be recognized as an integral part of the global financial system.

This isn’t uncharted territory, El Salvador has been using Bitcoin for years to combat inflation, regardless of political views, it’s undeniable that the country has managed to sustain itself by holding Bitcoin, which has outperformed its local currency.

Learning from the Evolution of Technology Narratives

History offers valuable insights into how new technologies are perceived over time. If you grew up in the 1990s, you likely remember when personal computers became household items. Initially, the internet was often portrayed in the media as a dangerous space filled with threats to privacy and security.

A memorable example is the 1995 film The Net which depicted the internet as a tool for hackers and identity theft.

Fast forward to today, and the internet is a fundamental aspect of everyday life. Of course, concerns about privacy, inappropriate content, monopolies, and unfair competition persist, but we now recognize the internet’s indispensable role in our world.

A Potential Turning Point: Government Endorsement of Crypto

Recent discussions suggest that the U.S. government may consider integrating cryptocurrencies into its treasury reserves. While such a move wouldn’t immediately make crypto a universally accepted financial tool, it would mark a significant shift in its cultural and financial narrative.

Imagine if the U.S. Treasury officially allocates a portion of its reserves to Bitcoin and Ethereum. Suddenly, media outlets like CNBC might shift from reporting on Bitcoin crashes to analyzing how cryptocurrencies impact national financial stability. Financial analysts on Bloomberg might debate digital assets versus traditional ones like gold, not as speculative bubbles but as serious financial considerations. Such a shift in media tone would inevitably influence public perception, framing crypto as a strategic financial tool rather than a risky gamble.

Beyond government endorsement, media narratives could further evolve through mainstream entertainment. What if a Netflix documentary showcased how blockchain technology enhances supply chain transparency in developing economies? Instead of focusing on scams, it could highlight the real-world applications of decentralized technology. Or imagine a film where financial advisors seriously discuss Bitcoin as part of an investment strategy, rather than dismissing it as speculative hype.

The Road Ahead: A New Cultural Narrative for Crypto

What could this shift mean for the future? Let’s consider some potential outcomes:

Mainstream Adoption: As governments and institutions integrate digital assets into their portfolios, individuals may feel more confident in doing the same.

Regulatory Clarity: Acknowledging crypto as a legitimate asset could encourage regulatory frameworks that promote stability rather than endless legal battles.

Corporate and Consumer Confidence: Businesses and individuals might begin to see cryptocurrencies as stable investments rather than high-risk speculation. While volatility may never fully disappear, institutional adoption could contribute to greater price stability and legitimacy.

Conclusion: The Turning Point for Crypto’s Reputation

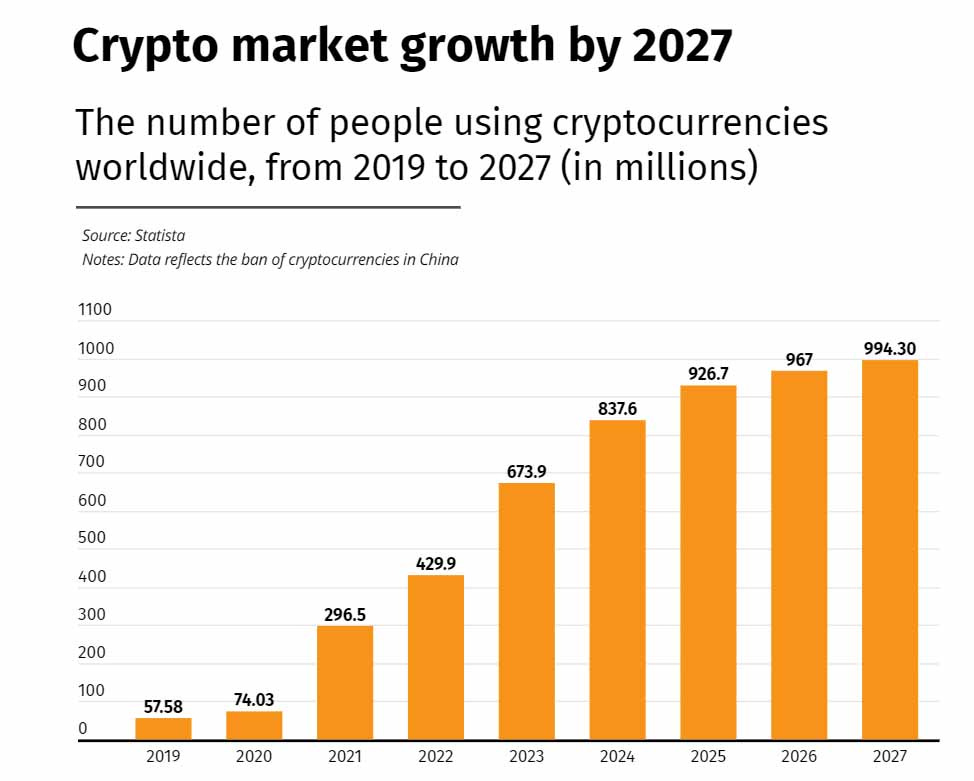

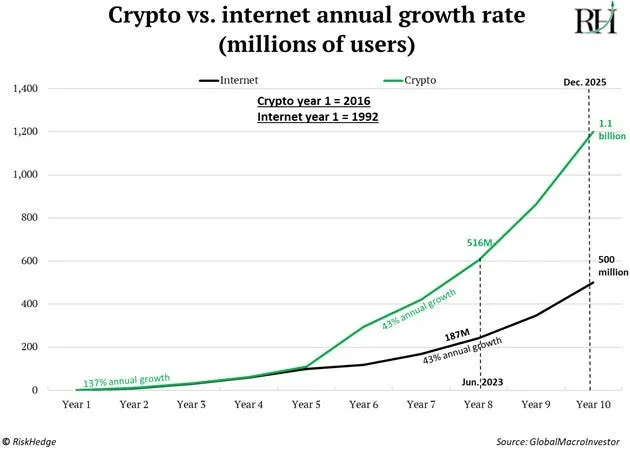

Despite persistent skepticism in mainstream media, cryptocurrency adoption continues to grow. In fact, crypto remains the best performing asset class of the past decade.

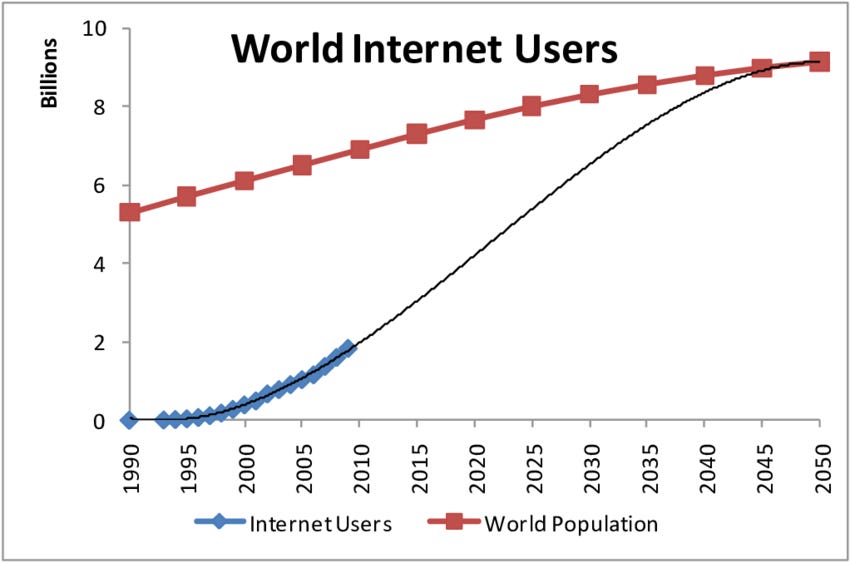

Just like the number of internet users surged by 70% per year between 1990 and 2000, blockchain adoption is currently growing at an even faster pace ~137% per year.

If the U.S. Treasury legitimizes cryptocurrency, it wouldn’t just validate the asset class. It would challenge the stigma surrounding it.

Crypto could stop being “that weird internet money” and start being seen as a legitimate part of the financial world. This shift wouldn’t just benefit the crypto sector but the global economy, providing more investment choices and opening doors to new technologies that are currently struggling to gain mainstream acceptance.

This change goes beyond markets. It’s about trust, identity, and how we define value in the digital age.

Yes, challenges remain, but if Institutions and Governments embrace crypto, it could mark the beginning of a new chapter, one where cryptocurrencies aren’t just for the few curious but for everyone.

While such a move wouldn’t immediately make crypto a universally accepted financial tool, it would mark a significant shift in its cultural and financial narrative.