The Evolution of Bridges in the Cosmos Ecosystem: Axelar’s Role

Bridging the Gaps: How Axelar is Expanding Cosmos’ Interoperability Beyond Its Ecosystem

Cosmos has always positioned itself as the blockchain of interoperability, focusing on horizontal scalability rather than vertical scaling, unlike Ethereum, which relies on multiple layers. With the introduction of IBC (Inter-Blockchain Communication), different Cosmos SDK-based blockchains began to interconnect through a technology that has proven to be secure and, in many ways, revolutionary.

Around $ATOM, the first blockchain based on Cosmos SDK, several other chains have emerged with different purposes, including:

Osmosis: the main Automated Market Maker (AMM) of the ecosystem

Stargaze: NFT-focused AMM

Juno: a platform for decentralized smart contracts

Injective and Kava: two additional AMM platforms

Stride: a liquid staking protocol

Celestia: a modular blockchain

Neutron: another smart contract platform

The Need to Expand Interoperability Beyond Cosmos

Despite IBC enabling communication between Cosmos-based blockchains, there was still no infrastructure to connect Cosmos with external networks such as Ethereum, Bitcoin, and Solana. This created an urgent need to develop a bridge that would extend Cosmos’ compatibility with the broader crypto ecosystem.

One of the first projects in this direction was Gravity Bridge, announced in 2021. This bridge allows users to transfer ERC-20 tokens, such as Tether (USDT), USD Coin (USDC), and DAI, between Ethereum and Cosmos. However, despite its effectiveness, Gravity Bridge does not provide direct connections to other EVM-compatible blockchains, thereby limiting its interoperability.

In 2022, Axelar was launched to overcome these limitations. Axelar is a Cosmos SDK-based blockchain designed to connect Cosmos with EVM-compatible blockchains, such as Ethereum, Polkadot, Avalanche, and more. Axelar introduces an innovative architecture that enables universal connections, allowing the direct transfer of tokens between two blockchains without first routing them back to their chain of origin.

This technology enables Cosmos to interact directly with more than 15 EVM-compatible blockchains. Axelar has quickly established itself as one of the most advanced and secure tools for transferring assets across blockchains, thanks to its General Message Passing system, which enhances both security and efficiency in cross-chain transactions.

Data Analysis: 3 Years of Axelar

To understand Axelar’s evolution, we analyze data from AxelarScan, a platform that provides insights into Total Value Locked (TVL) and trading volumes across connected blockchains, with a particular focus on Cosmos.

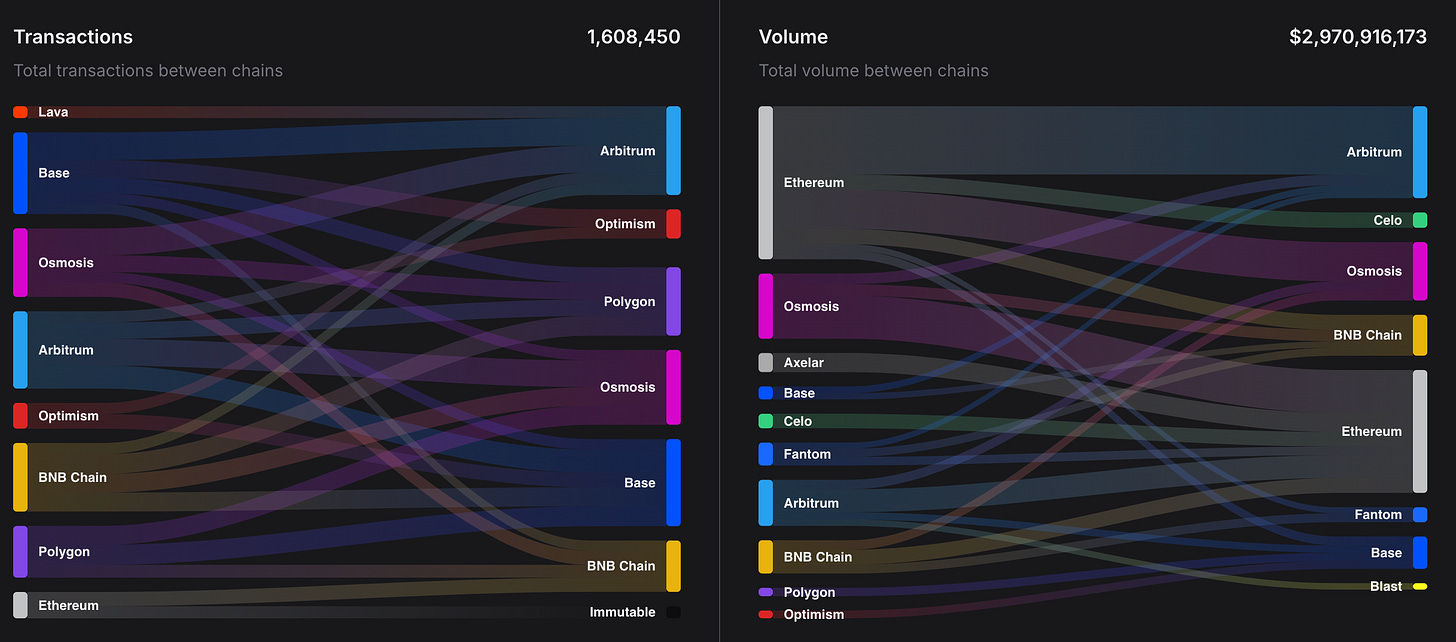

Key Data from the Last Year (February 2024 - February 2025)

1,700,000 total transactions

Approximately $3 billion in trading volume

450,000 active users over the past year

Average transaction size: around $1,800

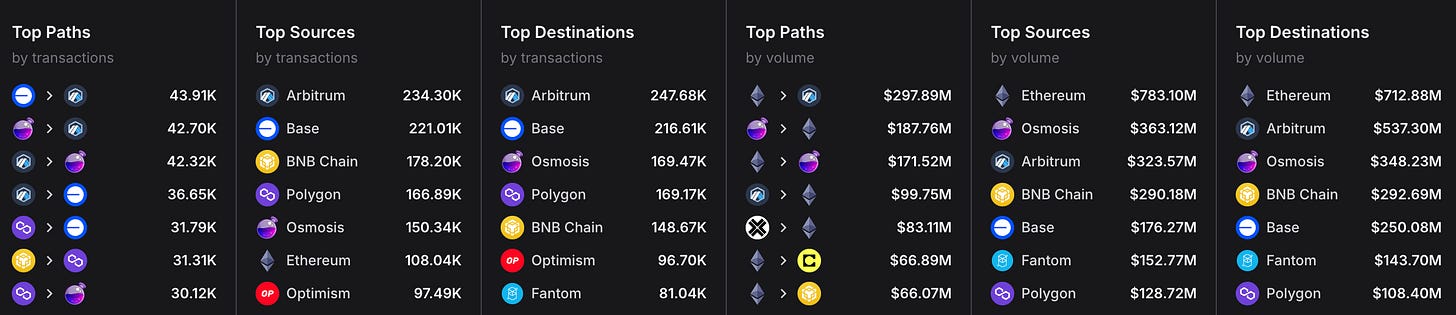

Top Destinations by Number of Transactions

Arbitrum

Base

Osmosis

Most Used Connections by Number of Transactions

Base ↔ Arbitrum

Arbitrum ↔ Osmosis

Top Destinations by Trading Volume

Ethereum

Arbitrum

Osmosis

Most Used Connections by Volume

Ethereum ↔ Arbitrum

Ethereum ↔ Osmosis

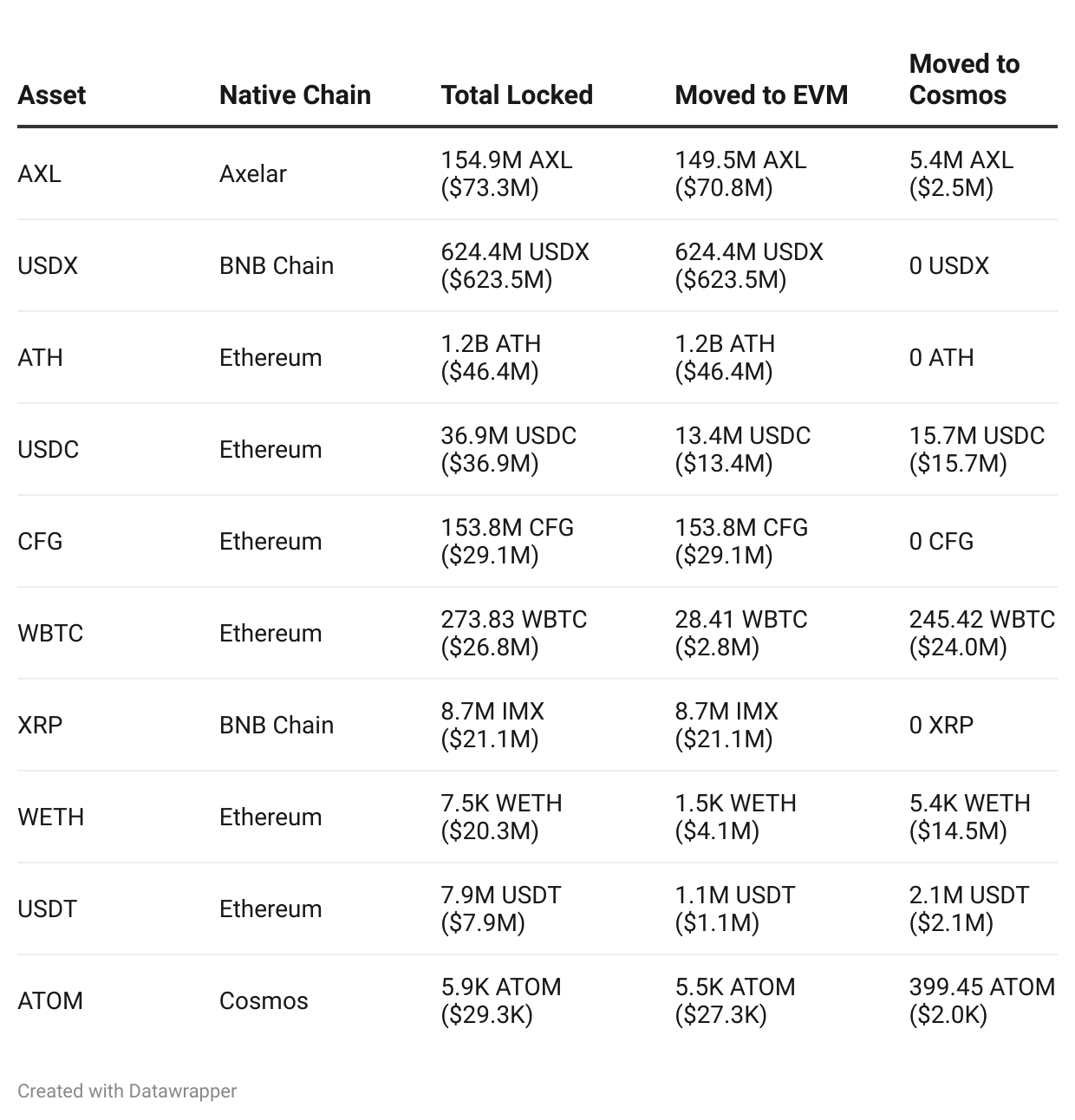

TVL: Where Are the Funds Moving?

Total Value Locked (TVL) represents the amount of funds that Axelar has transferred between blockchains and that currently remain locked on those networks. This data provides insights into user preferences and emerging trends in cross-chain activity.

Total TVL across all chains (as of February 11, 2025): approximately $1 billion.

$910 million on EVM blockchains

$60 million in the Cosmos ecosystem

The most commonly transferred assets are stablecoins like USDC and USDT, but the standout asset is USDX (not to be confused with Kava’s stablecoin), a synthetic stablecoin available on BNB, Arbitrum, and Ethereum, which alone accounts for $600 million in TVL (around 60% of the total).

Additionally, while Osmosis remains a major player, other blockchains like Kava are making notable moves, holding $50 million in TVL—a similar value to BNB and $10 million more than Osmosis.

It is also worth noting that Cosmos ($ATOM) has limited usage in bridges (approximately $20K in TVL for a blockchain in the top 50 is extremely low). Furthermore this token has yet to find a real utility, which is likely one of the reasons why its trend over the past few years has been underwhelming, if not entirely negative.

Axelar’s Role

Axelar has proven to be the most efficient and secure bridge, but its dominance raises some concerns:

Centralization Risk: If Axelar were compromised, it could severely impact Cosmos' interoperability.

Limited Competition: Other bridging solutions are emerging, but Axelar remains the only large-scale bridge in the ecosystem.

We believe that having multiple robust bridging solutions is essential to the long-term sustainability of Cosmos' interoperability.

Challenges and Opportunities for Cosmos' Growth

The analysis of Axelar’s Bridge highlights a Cosmos ecosystem that is rapidly evolving with a clear goal: enhancing interoperability not just within Cosmos-SDK blockchains, but also with EVM chains and beyond.

But while Cosmos has successfully established interoperability with multiple blockchains within its ecosystem, a key challenge remains:

Cosmos-based assets are primarily bridged into Cosmos but rarely out of it.

Why Are Cosmos Assets Not Used on Other Chains?

This has been one of the most relevant topics in the ecosystem recently, and we can summarize these issues in three key points:

Lack of DeFi Integration: Cosmos tokens are not yet widely adopted in major DeFi platforms outside Cosmos, such as Uniswap, Aave, or Curve.

Limited Wrapped Assets: Unlike wBTC or wETH, which are widely used on different chains, there are no highly liquid wrapped versions of ATOM, OSMO and others on Ethereum L2s or on any other blockchains.

User Experience Barriers: Moving assets from Cosmos to Ethereum or Solana may require technical knowledge, making it less accessible for retail users.

So how can Cosmos encourage the adoption of its native assets on external ecosystems? Here are our thoughts:

Integrating Cosmos assets into Ethereum L2s: Partnerships/integrations with projects like Arbitrum, Optimism, and Base could provide liquidity incentives.

Developing better cross-chain UX: More intuitive bridging solutions, directly integrated into popular wallets like MetaMask and Phantom, could simplify asset transfers.

Incentivizing external liquidity providers: Offering yield farming or staking rewards for providing liquidity in Ethereum, Solana, and Avalanche-based AMMs.

Conclusions

Cosmos has made significant strides in cross-chain interoperability, The introduction of IBC and the evolution of Axelar have made Cosmos a highly interconnected network internally, but it’s struggling to step out from its ecosystem, the limited adoption of its assets outside its ecosystem represents a long-term risk.

If this trend continues in this direction, Cosmos risks losing relevance in the crypto landscape, remaining confined to a niche rather than establishing itself as a key player in the industry. To prevent this scenario, it is crucial for the main stakeholders in the ecosystem to work towards fostering cross-chain adoption—perhaps by implementing liquid wrapped assets on Ethereum and other major blockchains, as well as expanding the use cases of ATOM and other Cosmos assets.

On this front, the Interchain Foundation has taken a significant step by acquiring Skip Protocol. With this move, it has secured a team that has already demonstrated its ability to deliver reliable and effective solutions. We hope that this acquisition will help address one of the most pressing issues of recent years, which has yet to be fully resolved.